The corporate reporting period has is ending.

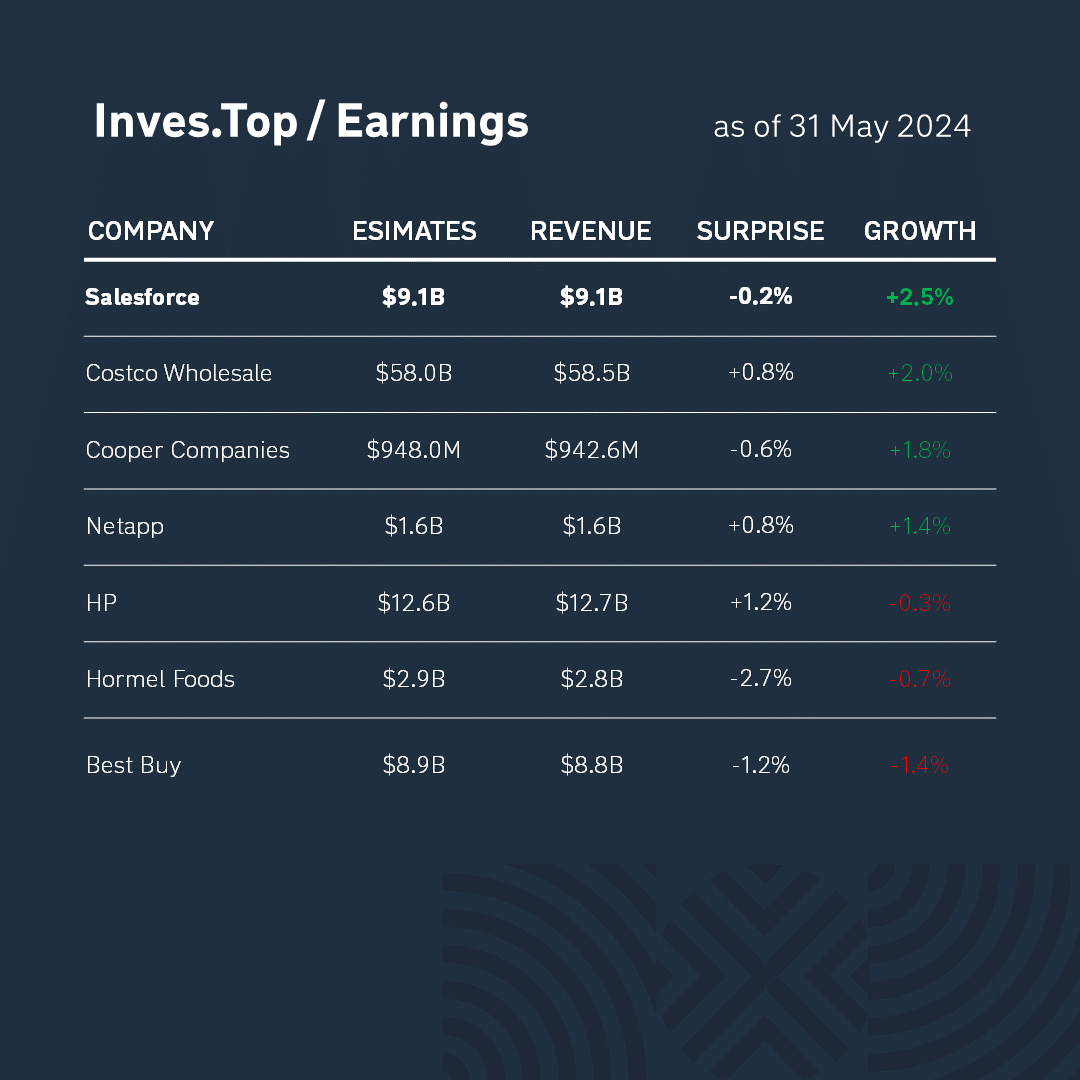

Last week, 9 companies from the S&P 500 index reported.

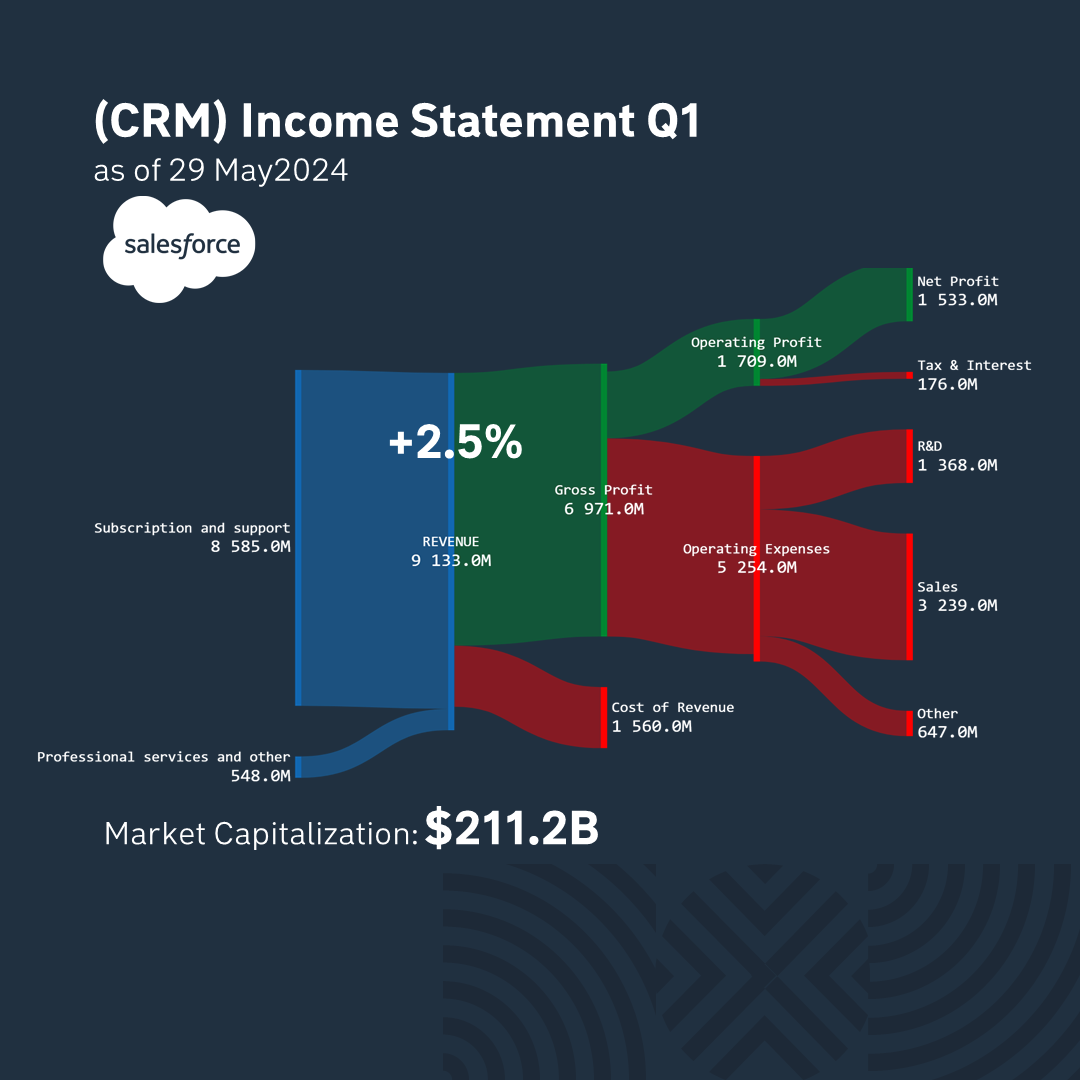

Today, we’re going to look at Salesforce’s results, with revenue of $26.0B. It grew by +2.5% compared to the corresponding value for the previous quarter, but did not exceed analysts’ expectations by -0.2%. Let’s analyze the company’s business in more detail.

Salesforce is one of the world’s largest cloud software developers, ranked 491st in the Fortune 500. The company serves 150 thousand corporate clients through its main platform Customer 360, which helps to aggregate all the necessary information about customers from various sources to improve interaction. The company also develops separate applications for marketing strategies, AI-based data management, and software development.

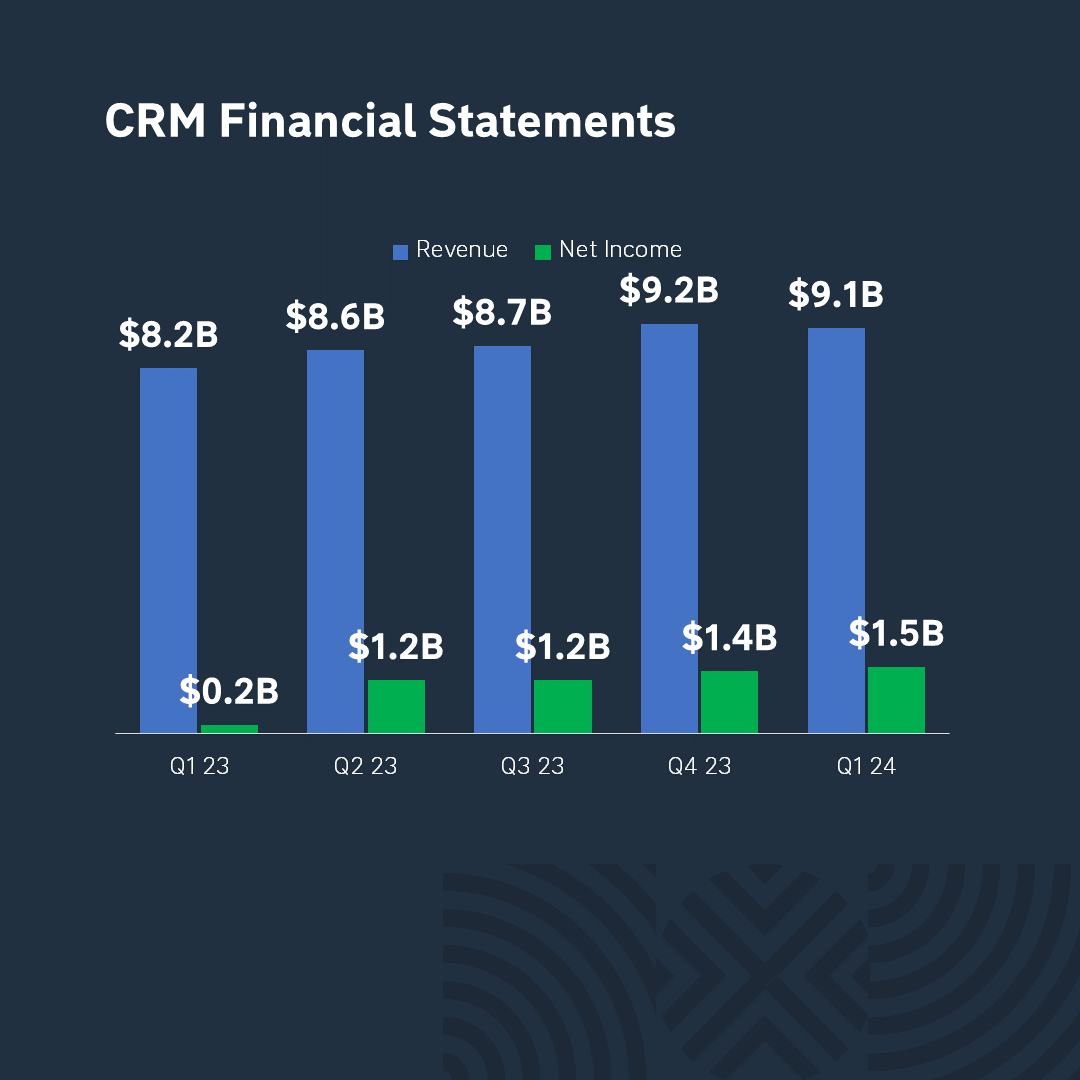

The company’s revenues increased by +10.9% year-on-year. This revenue growth was driven by a high annual customer retention rate of +92%. Since 2022, the company has been buying back shares, as of 1Q, the company has $18B reserved for this purpose, and since 2024, Salesforce has introduced quarterly dividend payments.

17% of the revenue structure is made up of product manufacturing costs, and 83% is gross revenue. Over the past quarter, the company made a profit of $1.5B. Its market capitalization is $211B.

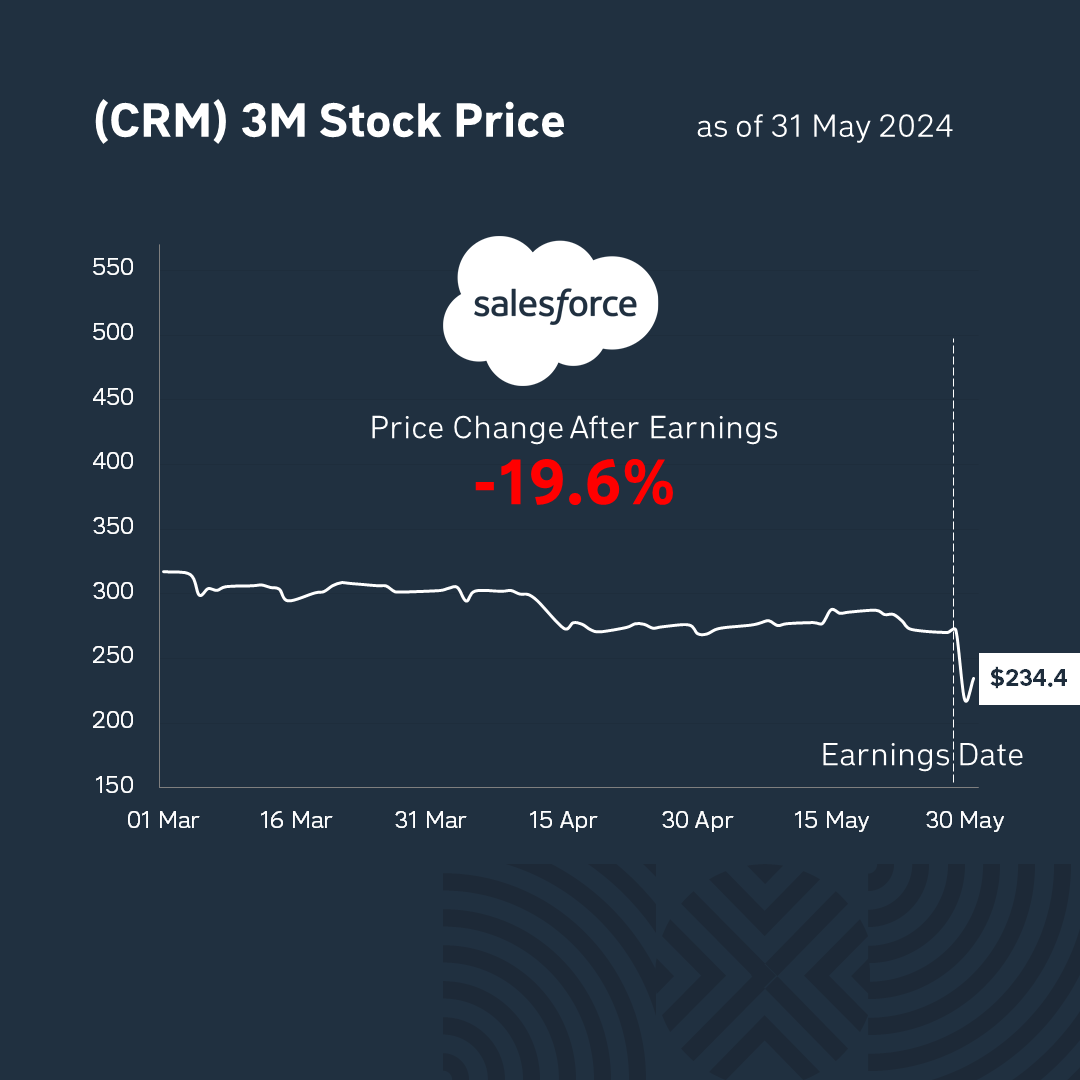

After the publication of the report, Salesforce shares fell by -19.6% to $232 per share. Market participants are dissatisfied with the company’s financial results and react negatively to the company’s development prospects.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter