Last weekend, when the week had not yet begun, it seemed like it would be a quiet and peaceful one. There was no sign of anxiety: no earth-shattering economic reports, no mega-company second-quarter results, and no new US presidential candidates. Most investors were hoping to catch their breath after the turbulence caused by the not-so-flattering results of the Labor Market Report, but it didn’t happen as expected! In fact, veteran investors even began to recall Black Tuesday, during which the Dow Jones lost 23% in one day in 1987. This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

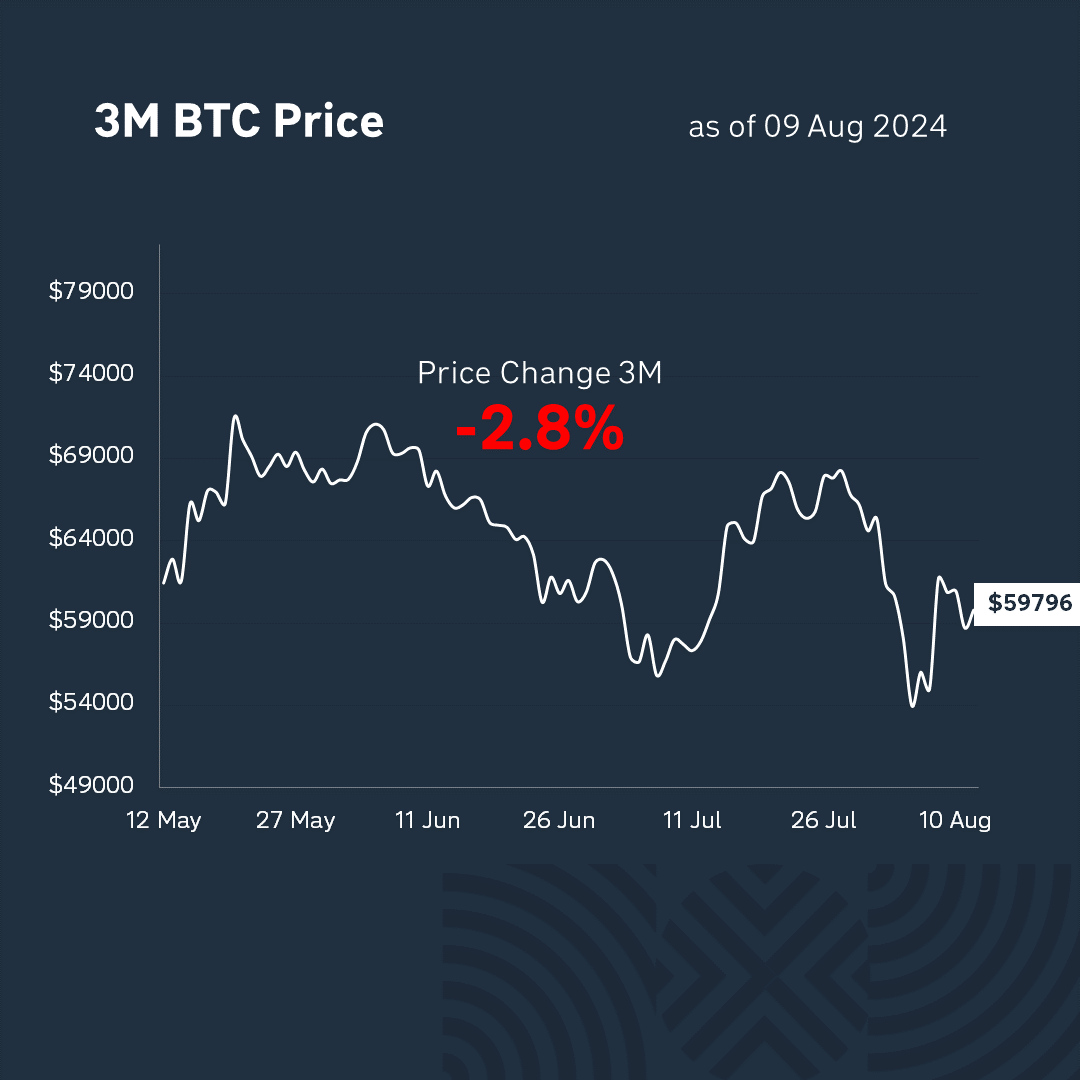

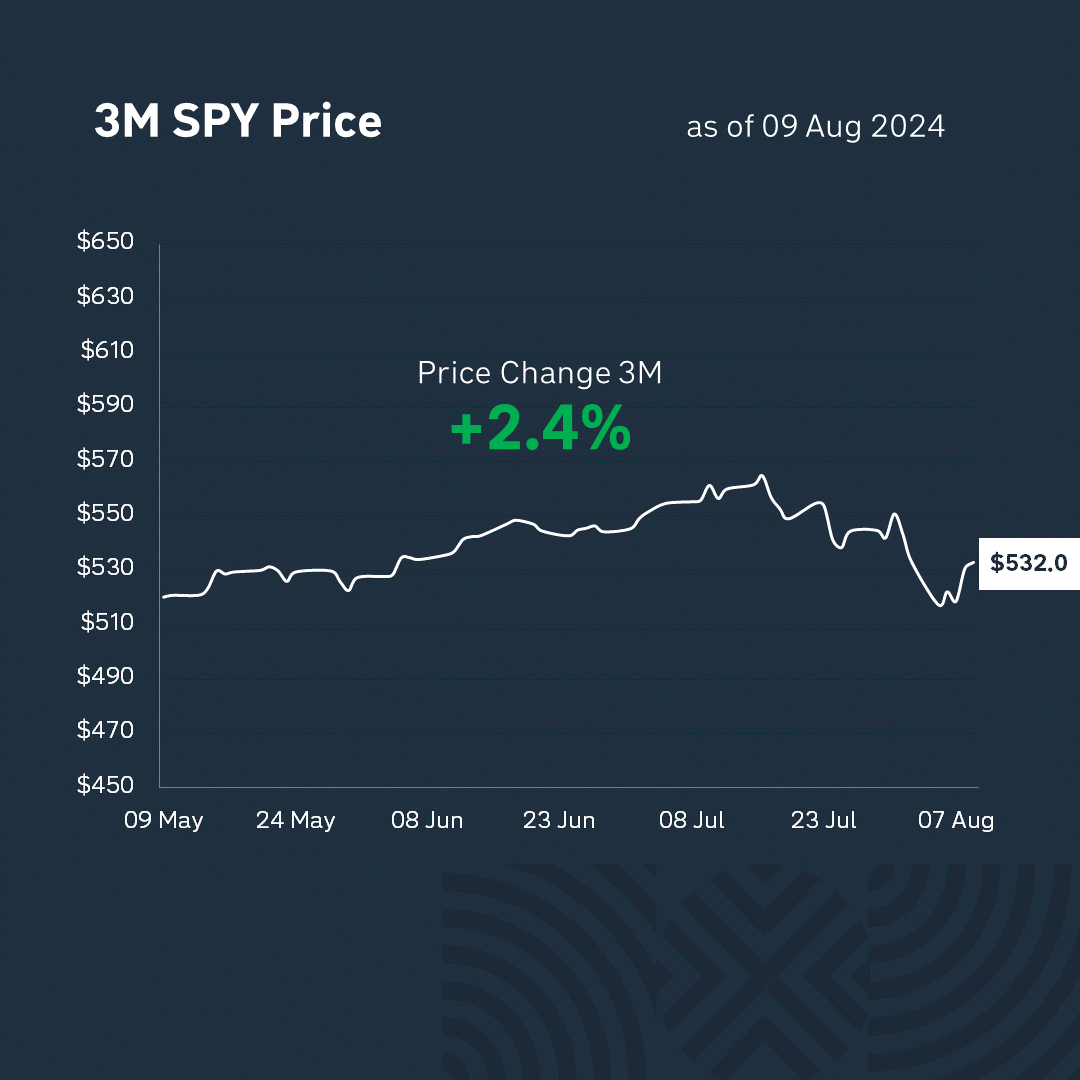

Monday began with a plunge that hit the markets: everything was red, from futures to cryptocurrencies, and only bonds were saved. The reasons were varied: weak US economic indicators, poor company results, panic in Tokyo, where the Nikkei 225 fell by 12%, and overheating of the markets. Buffett, by selling some of his Apple shares and keeping $277 billion in cash, exacerbated the panic. However, it later became known that he was positive about the state of the economy.

On Tuesday, the markets calmed down, avoiding a further drop that could have led to a financial crisis. Investors were calling for the Fed to cut rates, and the likelihood of such a move was growing. However, the markets resisted.

Wednesday started with growth, but in the afternoon panic reigned again, ending the day with a drop. Investors were waiting for Thursday, when new labor market data could have an impact on the markets.

Thursday brought relief: fewer jobless claims gave hope that the recession was being reversed, and the indices soared. However, if the markets fall on Friday, it will be the fourth consecutive week of declines and global markets will lose $6.4 trillion. Volatility remains a major factor, so it’s worth keeping your seat belts fastened.

But the week is not over yet… If today, Friday, the indices fail to hold on and head south, it will be the fourth week of declines in a row. Bloomberg estimates that global markets have lost about $6.4 trillion dollars during this time. That’s a lot!

How will the events unfold further? I’m sure no one knows for sure, but some steam has been released this week. Although, a day or two of growth to new highs will undoubtedly increase the pressure again. In fact, in terms of fundamentals, little has changed since Monday, and just as good economic data on Thursday helped the markets recover, any bad news in the coming days could stir up new fears of recession and trigger a new round of declines. Or maybe not… So, it’s business as usual, and any developments in the markets can be explained in one word: “Volatility!”.

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.