It was a week of continuous optimism and new records set by stock market indices, inspired by good news from a variety of fronts. The Dow Jones even reached 40,000. Of course, the main issue on investors’ agendas remains inflation and a possible Fed rate cut, so everyone was looking forward to Wednesday, when the US consumer inflation rate (CPI) was to be announced. This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

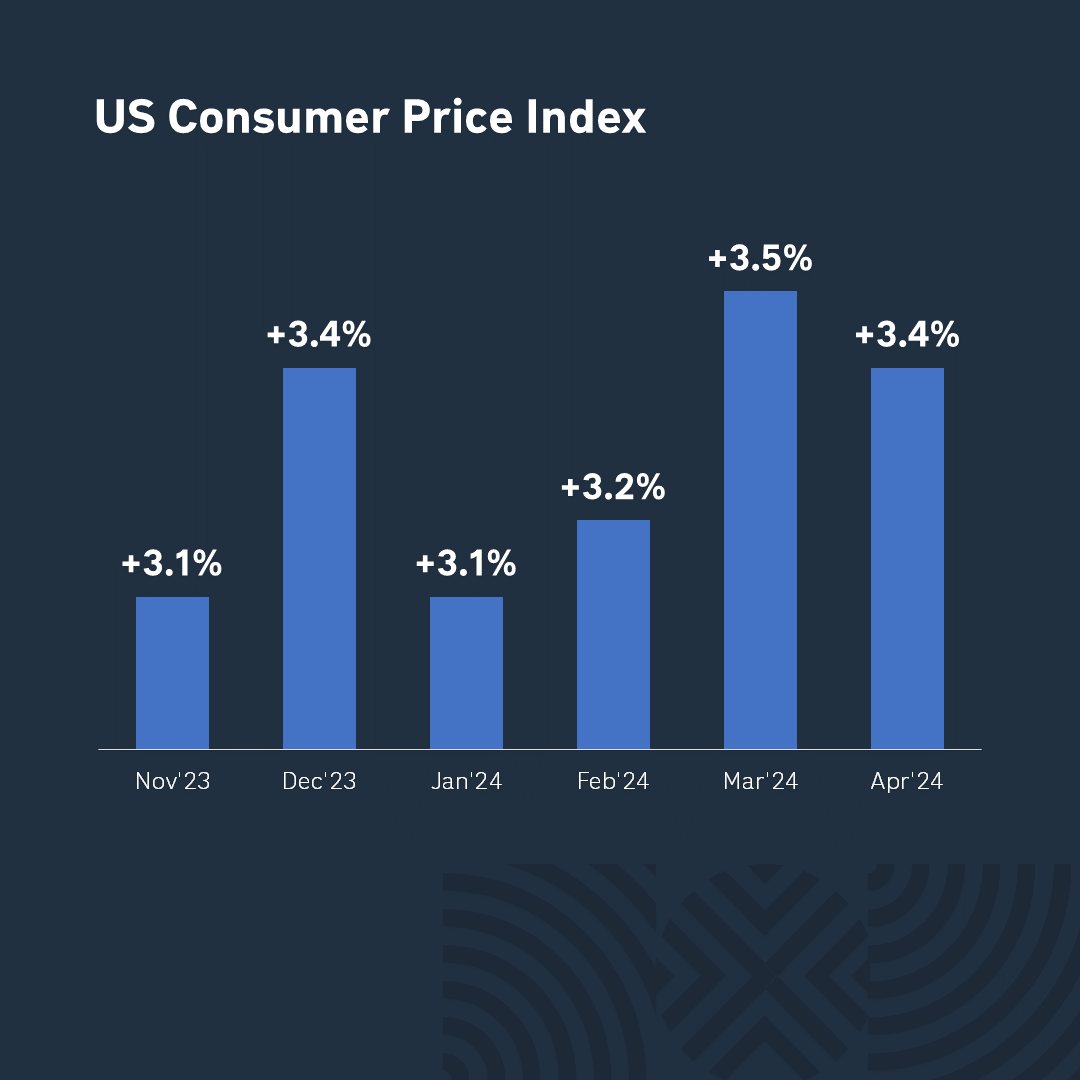

Inflation (CPI) was lower than expected: annual inflation in the US fell to 3.4% in April, down from 3.5% in March. Monthly prices rose by 0.3%, better than the expected 0.4%. While these statistics are positive, they are unlikely to prompt the Fed to lower rates soon. However, many investors see this as a “step in the right direction.”

The Fed is in no hurry. Speaking in Amsterdam before the CPI announcement, Jerome Powell expressed less confidence in a steady decline in inflation compared to the beginning of the year, indicating the need for patience before cutting interest rates. “We didn’t expect it to be a smooth ride, but inflation was higher than anybody expected,” Powell said, highlighting the need for patience. JP Morgan’s CEO also believes the likelihood of high inflation and rising rates is greater than many think. Even amid mass optimism, professional skepticism persists.

An interesting incident occurred during the CPI announcement. Bloomberg reported that the Bureau of Labor Statistics (BLS) accidentally released the inflation figures thirty minutes ahead of schedule. Surprisingly, no one seemed to capitalize on this premature release of critical market information. An investigation will follow, but this sets a precedent. Now, it’s worth periodically checking the agency’s website for any early releases of important and confidential information.

The highlight of the week was the return of “Roaring Kitty,” known as Keith Gill, the trader who ignited the meme stock frenzy in 2021. Many professional investors recall him with frustration, as his actions led to massive losses for several investment funds, with some even going bankrupt. Gill’s comeback was dramatic: GameStop’s share price quadrupled in two days, causing billions in losses for short-sellers. AMC Entertainment, another meme stock favorite, also saw similar volatile swings. This showcases the power of social media and human greed.

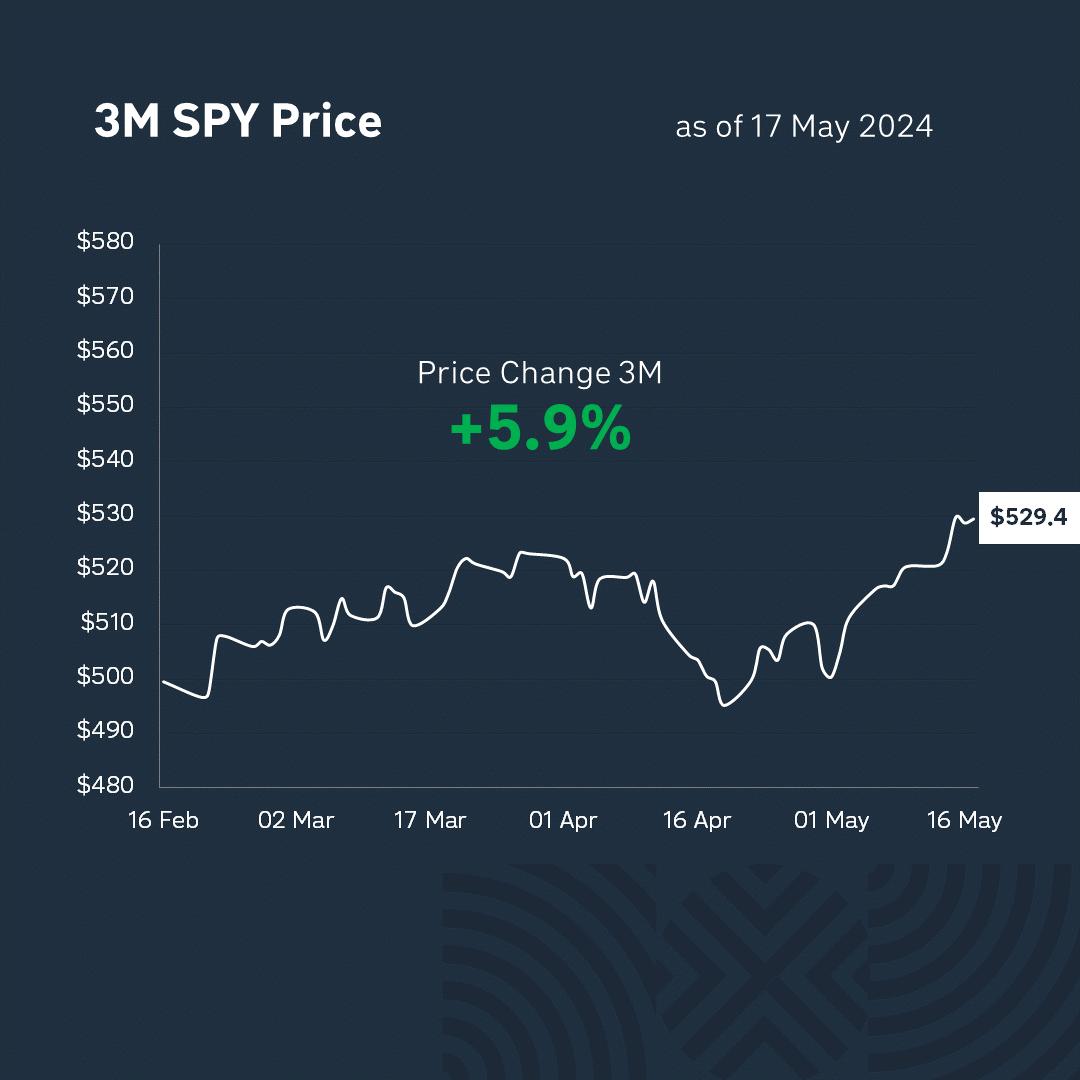

In general, after the announcement of the CPI, the markets are optimistic – the S&P 500 is hitting record highs, bears are hiding in their dens, meme stocks are flying up and down again – it’s time to think about risks, because when everything is too good, something will definitely go wrong.

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.