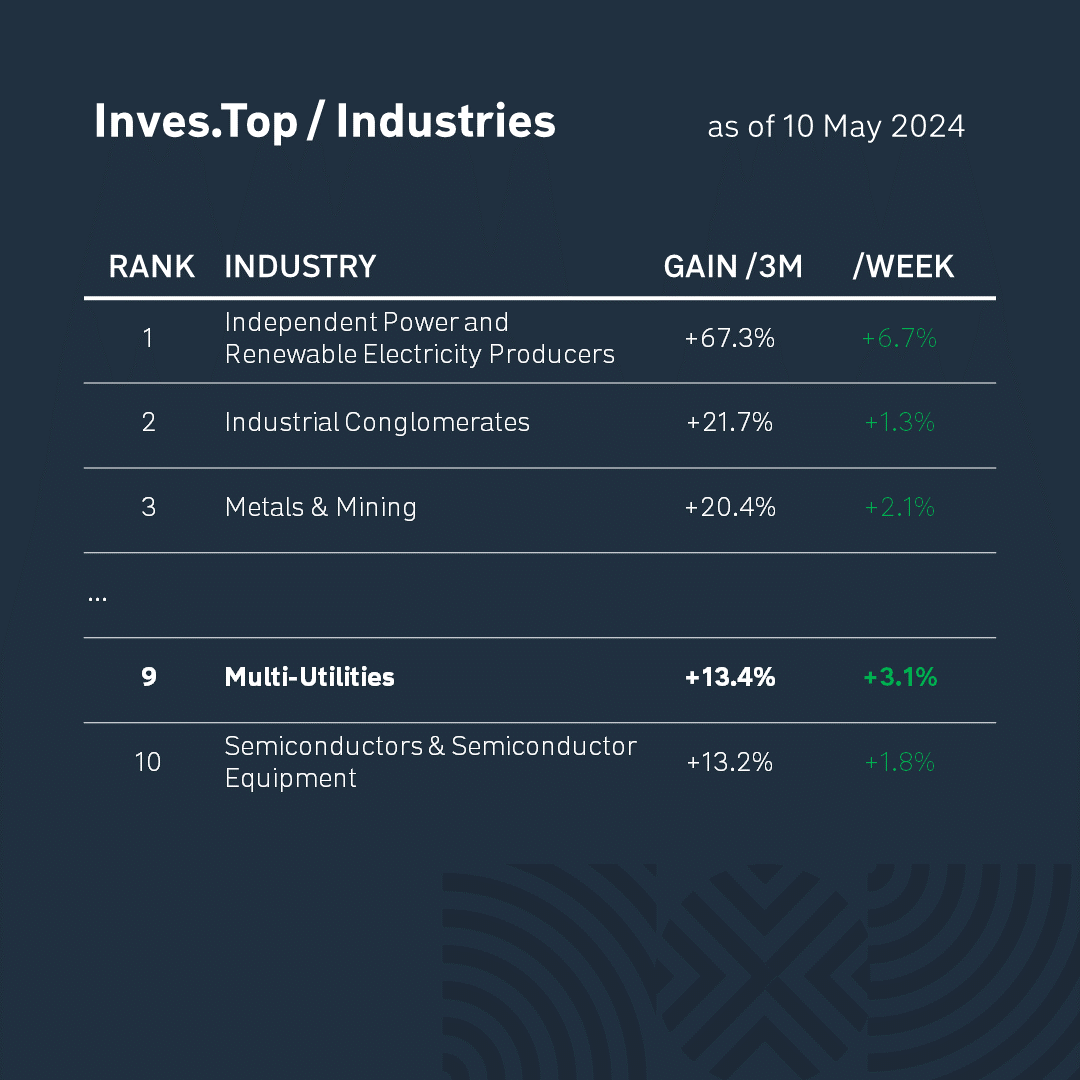

Over the past three months, one of the top performers in the S&P 500 index has been the Multi-Utilities industry, up 13.4%.

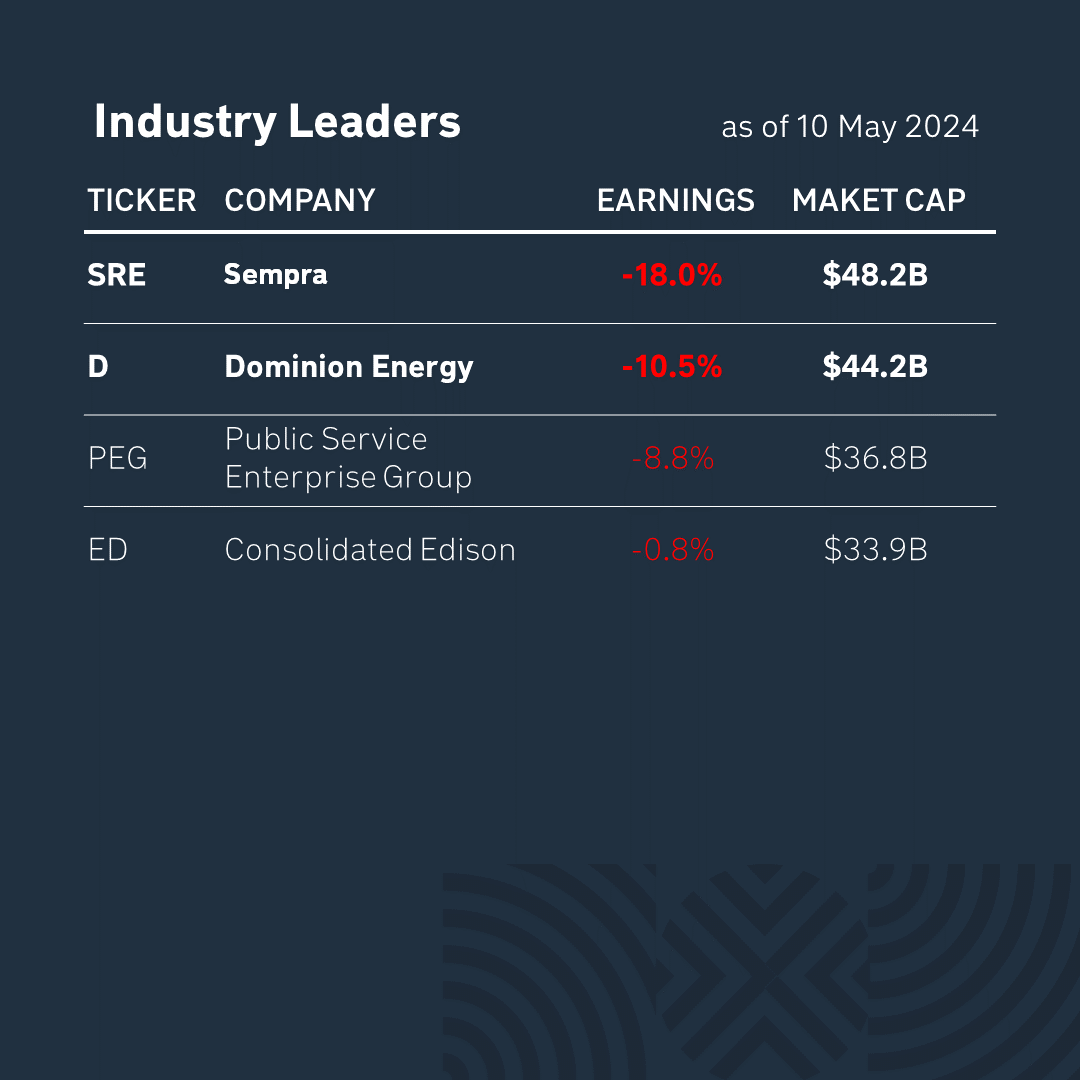

Some of the largest (by market capitalization) companies in this industry: Sempra ($48.2B), a utility company that supplies natural gas and electricity to 20 million customers in the United States through its subsidiaries, and Dominion Energy ($44.2B), which produces electricity from a total generating capacity of 30 gigawatts and manages an infrastructure of more than 100 thousand kilometers of power lines.

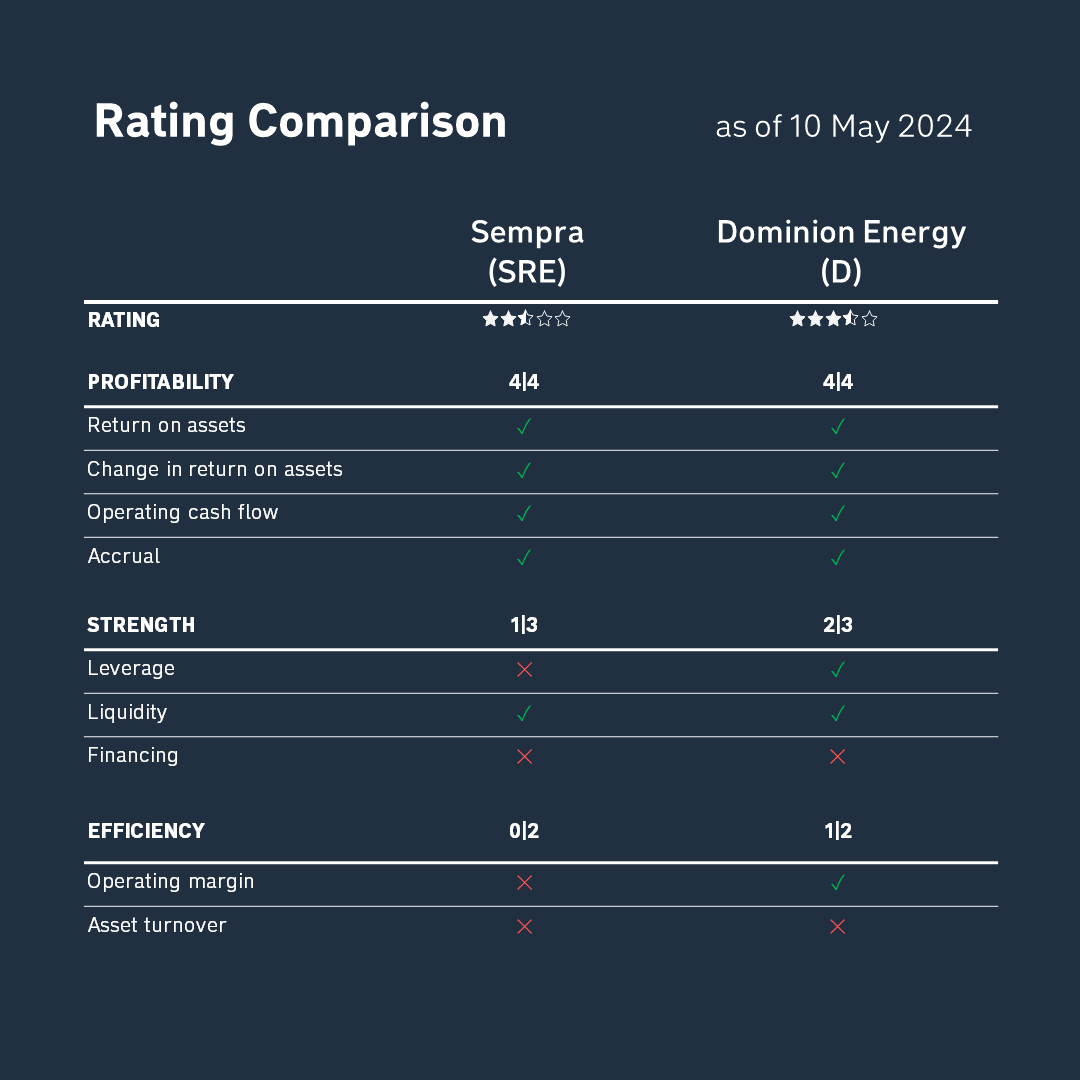

According to the latest quarterly reporting data, we analyzed each company’s profitability, strength, and efficiency criteria using the methodology of Stanford University professor Joseph Piotroski.

As you can see, Dominion Energy is showing stronger results in terms of fundamentals and outperforms Sempra in terms of profitability, sustainability and efficiency.

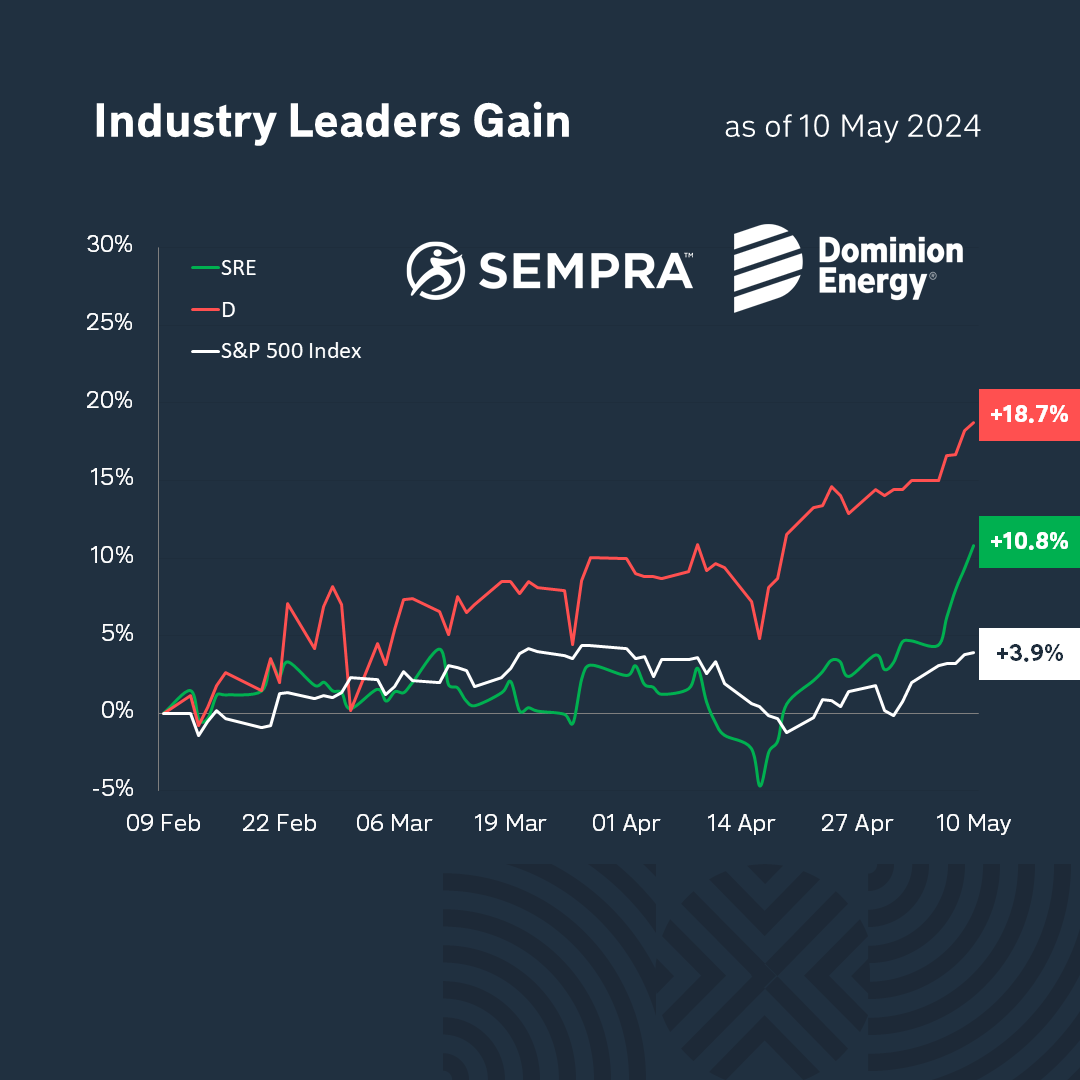

Over the past 3 months, Sempra’s stock has risen by +10.8%, while Dominion Energy’s has increased by +18.7% (the S&P 500 index has risen by +3.9%). Dominion Energy has outperformed its closest competitor and demonstrated better results compared to the index.

So, the winner in today’s battle is Dominion Energy (D). Dominion Energy’s business looks healthier in terms of leverage and operating margin, and the stock is showing better returns.

* This is not an investment recommendation. It is up to each individual to decide which criteria to favor when making an investment decision, taking into account their goals and individual risk tolerance.