Last week once again has demonstrated the fearlessness of today’s investors. No matter what happens in the markets, no matter what data is released, and no matter what warnings are issued by regulators, none of this stops investors from wanting to buy a share of a happy future, no matter how much it costs. This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

Investors faced a test this week with the release of consumer inflation data. Despite optimism, reality proved challenging as December’s price growth exceeded expectations, validating the Fed’s caution. This dashed hopes of immediate monetary policy easing, pushing back rate cut expectations until at least June according to futures markets. Investor disappointment was evident as indices dipped, sparking concerns and prompting some to consider asset sell-offs.

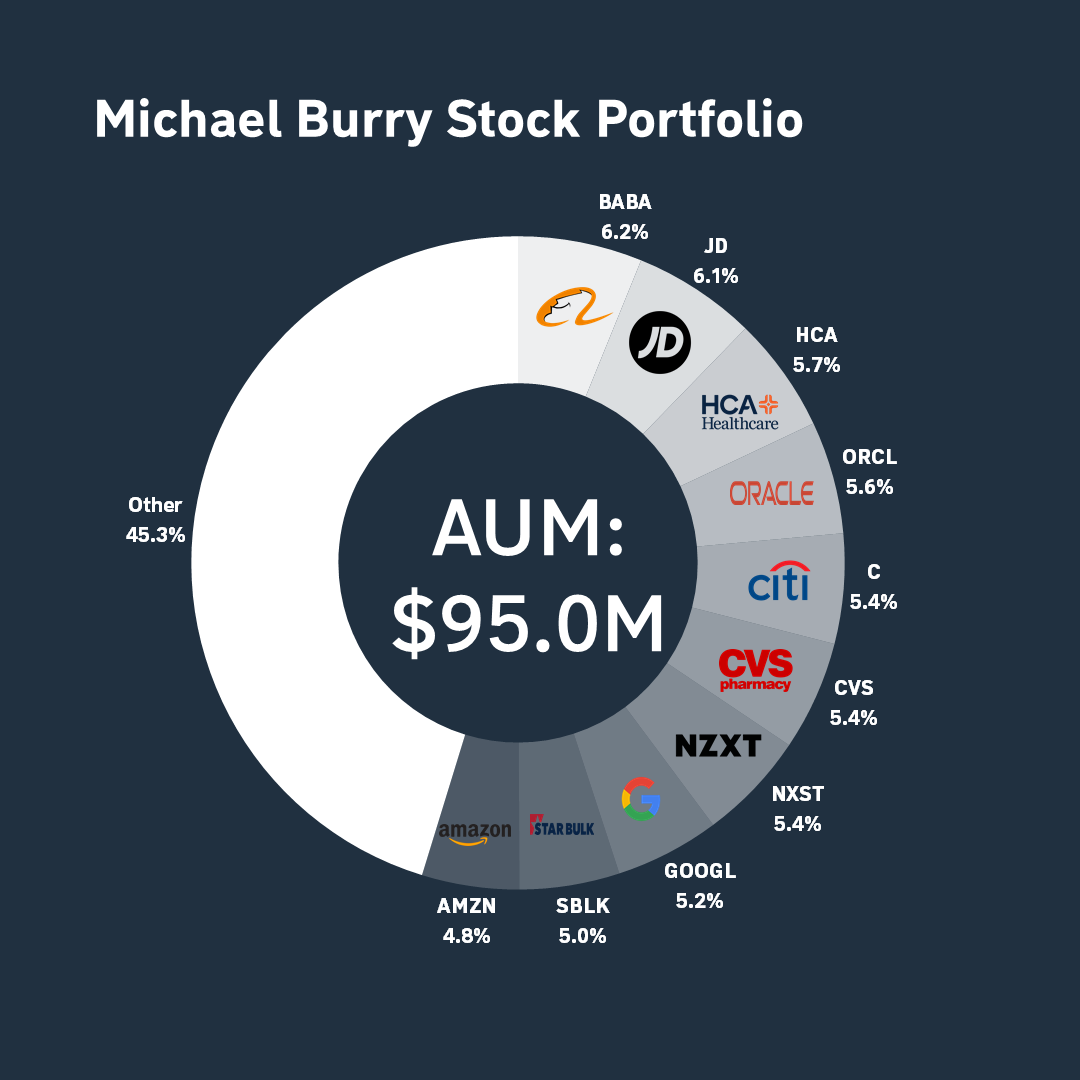

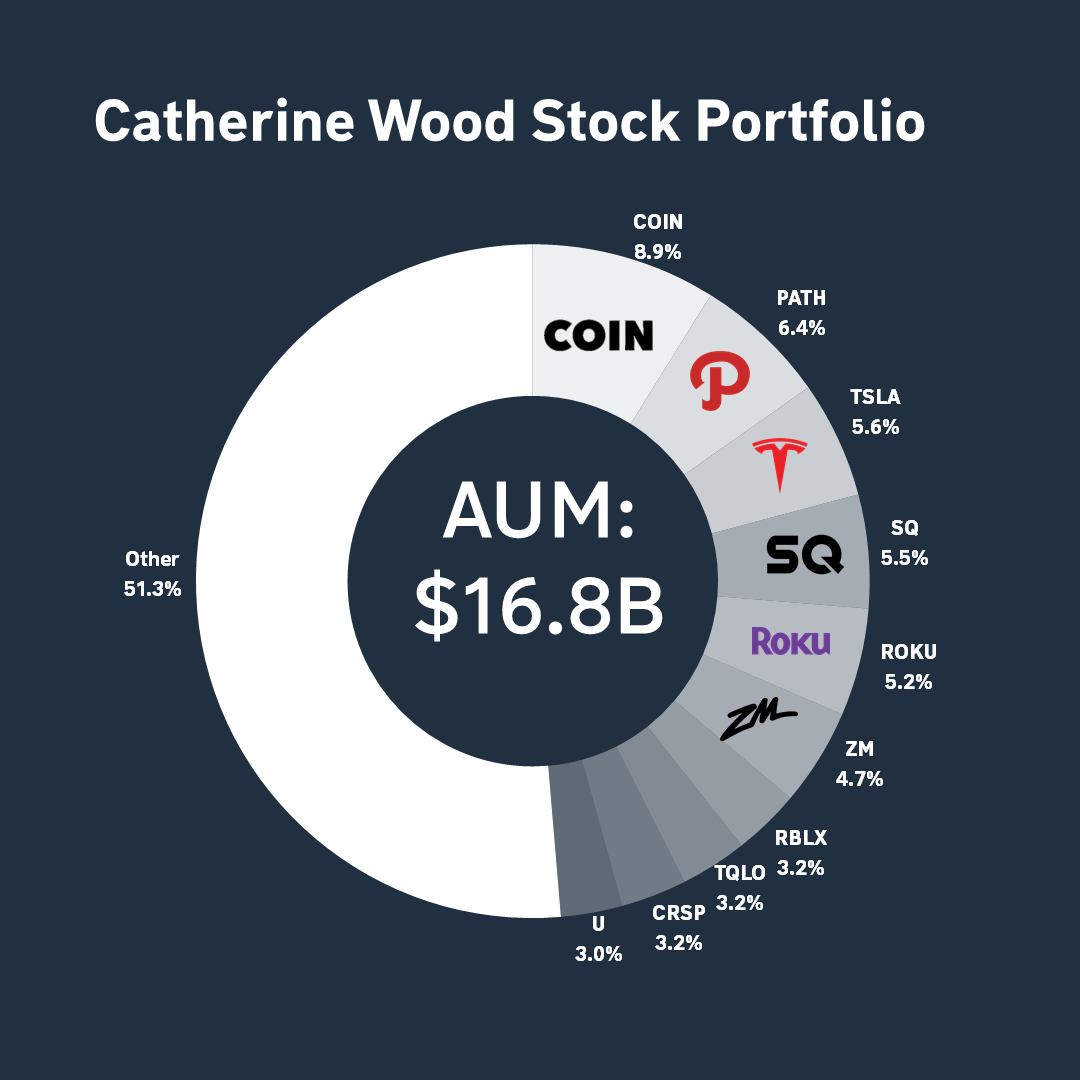

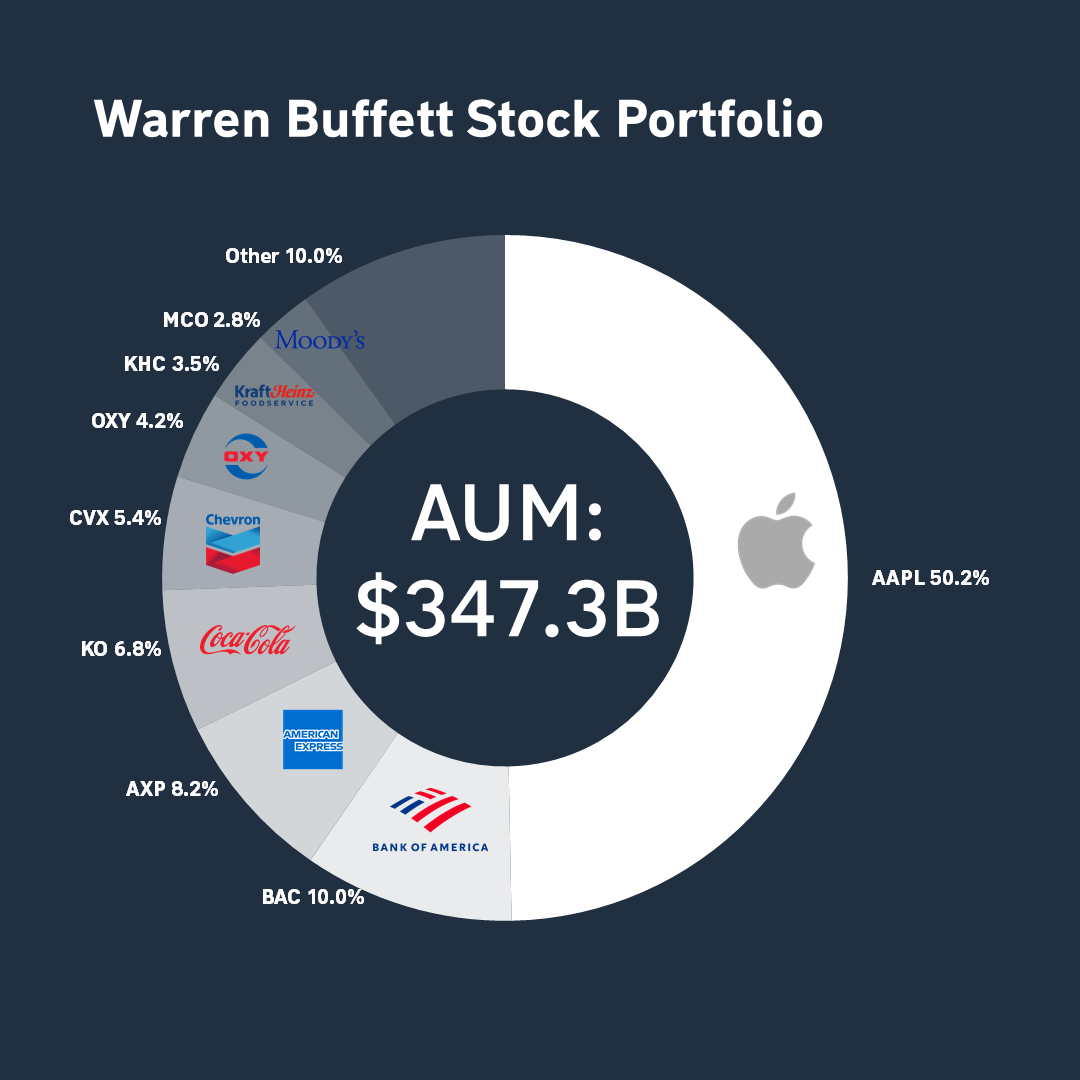

However, Wednesday revealed that optimism prevailed over caution: investors rallied the market, recouping a significant portion of the previous day’s losses. Despite concerns about inflation, investors seemed to trust in the potential of AI to mitigate the issue, driving continued investment in tech-related companies. The faith in tech giants like Apple, Amazon, Meta, Alphabet, Tesla, Microsoft, and Nvidia remained unshaken, despite their lofty valuations. Notably, even noted skeptic Michael Burry ventured into Amazon and Alphabet, while Buffett, though dubbed “old-fashioned,” diversified into oil stocks like Chevron and Occidental Petroleum, a move that has consistently outpaced the strategies of more modern investors like Katie Wood in recent years.

Thursday brought a new challenge – retail sales declined significantly, which is definitely bad for the economy, but investors’ faith in endless growth has held up again. And not only did it survive, but it also ensured that the S&P 500 rose to a new all-time high. Obviously, neither higher-than-expected inflation nor a drop in retail sales can affect investors’ desire to buy more, no matter what the price.

As the week concludes at record highs, the question arises: what lies ahead? While investor belief can be a powerful force, the current market trajectory appears increasingly risky. Perhaps it’s time to shift focus towards companies with strong fundamentals overshadowed by the Big Seven. Typically, such firms offer stability when growth falters. Additionally, rising inflation data has driven bond yields up, presenting a potential opportunity for low-risk returns.

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.